|

Main Stories

Growth of Indian newspapers during recent times

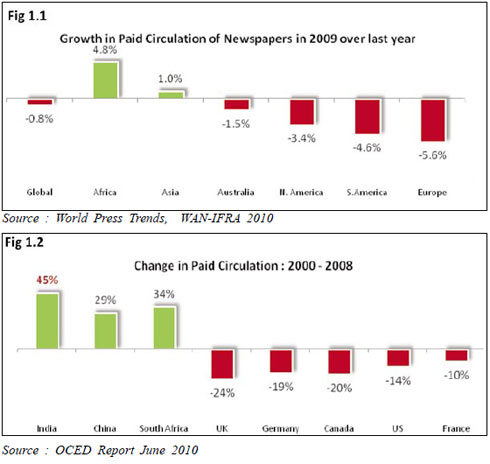

Like in many other fields, the Indian experience does not quite fit into trends across the world. The case of newspapers is one that exemplifies this general statement. It goes without saying that the growth of newspapers in India, especially in recent years, is directly related to the growth witnessed by the Indian economy. D D Purkayastha, chief executive officer, ABP Pvt Ltd, Kolkata briefs. I n the developed economies, paid circulation for newspapers is on the decline.(see figure 1.2) The decline is so marked that the very existence of newspapers in the not-too-distant future is seen to be in doubt. But this trend is opposed in the developing economies of Asia and Africa as is evident from figure 1.1. In India, the growth in paid circulation is somewhat spectacular 45% in the year 2008 over 2000.

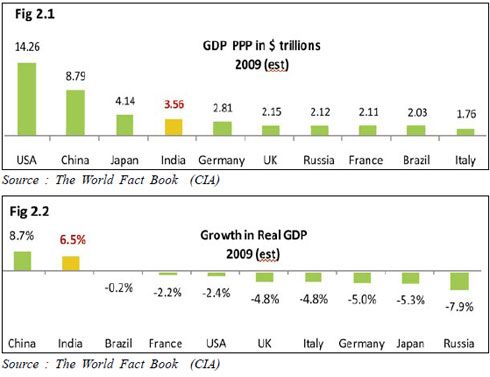

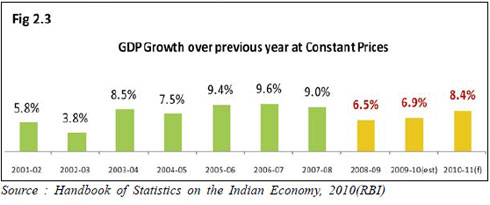

Let us now look at the Indian experience in some detail. It goes without saying that the growth of newspapers in India, especially in recent years, is directly related to the growth witnessed by the Indian economy. India is the 4th largest economy in terms of GDP PPP (see fig 2.1) and the 2nd fastest growing among the 10 largest economies in the world in terms of GDP PPP. (see fig 2.2). When all the leading economies experienced a meltdown in 2009, the Indian GDP grew at 6.9% in 2009-10. In 2010-11, the forecast is that the Indian economy will see a further growth of 8.4%. In fact, the Indian economy has grown consistently since 2003-04.(see fig 2.3).

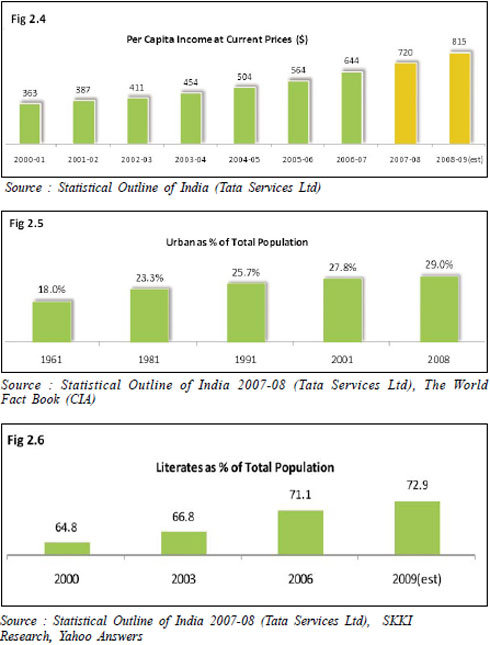

In India, this growth has been buttressed by a steady rise in per capita income. As figure 2.4 shows per capita increased by 60% in 2008-09 over the levels prevailing in 2005-06. Further, urbanization is on the rise: urban population as a percentage of total population has increased from 25% in 1991 to 29% in 2008. This is also reflected in the growing importance of KUT (Key Urban Towns) and ROUI (Rest of Urban India) from a consumption standpoint (see fig 2.5). Literacy level, so important for understanding the growth of newspapers, stands at 72.9% in 2009. Whereas in the year 2000 it stood at 64.8%. (see fig 2.6).

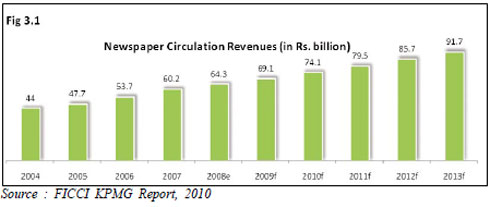

This growth of the Indian economy had its impact considerably on the newspaper industry. Circulation increased, resulting in increased revenues. And this is expected to grow at 8.5% CAGR over the period 2004-13, as illustrated in figure 3.1.

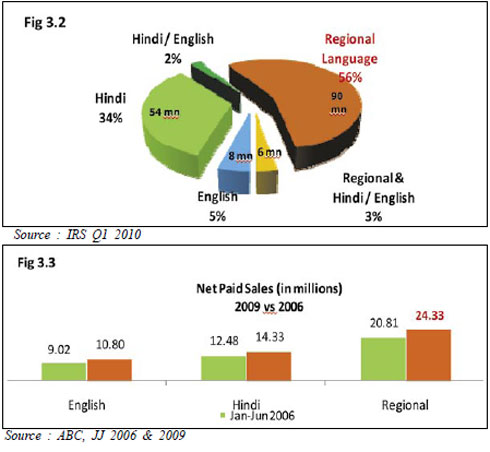

In India, the dailies in regional languages command more than half of the Average Issue Readership in 2009 as per IRS Q1 2010. There are 90 million readers of dailies in the regional languages as compared to 54 million for dailies in Hindi and 8 million for dailies in English.(see fig 3.2) If we turn to growth in net paid sales, dailies in regional languages have increased by almost 4 million copies in Jan-June 2009 over Jan-June 2006 as per the Audit Bureau of Circulation. The corresponding figures for Hindi dailies is 2 million and for English dailies remaining at one million (see fig 3.3).

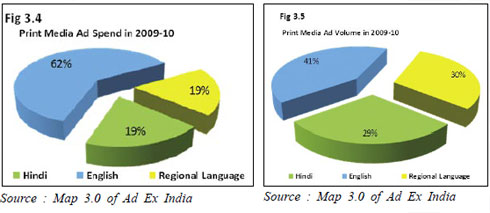

Inspite of these figures, level of advertising volumes, English dailies are enjoying, goes far ahead of dailies in regional languages and Hindi. Dailies in English have a 40% share in terms of advertising volumes in 2009-10, while Hindi dailies and those in regional languages have a modernate share of 30% each. (see fig 3.5). When it comes to value, English dailies command a share of over 60 per cent in terms of advertising revenues while Hindi and regional dailies share the rest almost equally. (see fig 3.4)

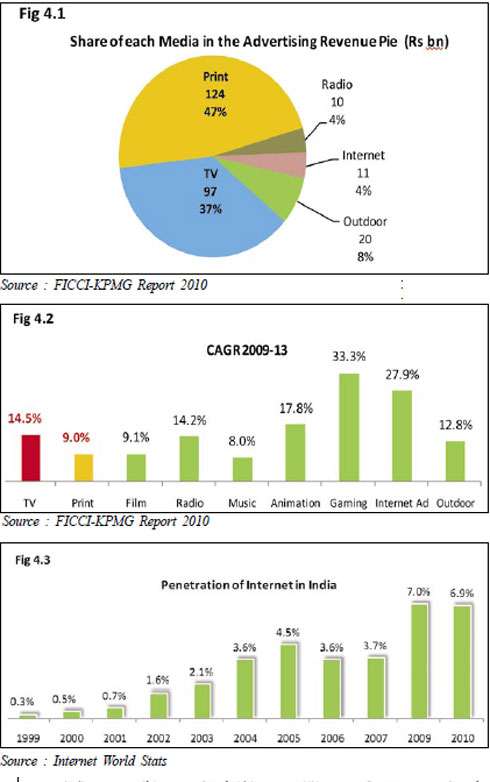

It is obvious that from advertisers point of view, dailies in English remain the favourites. Advertisers, with some justification, perceive readers of English newspapers to be more socially sophisticated with higher purchasing power and therefore more open to new products, risks and experimentation. The story of growth of newspapers in India should not deflect attention from the problems that newspapers are facing. The media space is fragmented. Apart from print and television, radio, filmed entertainment, music, animation, agaming, internet and outdoor are also competing for the attention of consumers. Though the largest share of the advertising revenues of the Media & Entertainment Industry in Rs billion is taken by Print Media (47%), with television (37%) coming second; Outdoor (8%) coming third and followed by Radio and Internet Advertising with a 4% share each, the new media --- music, gaming and animation, whose share is insignificant, cannot be completely ignored. (see fig 4.1)

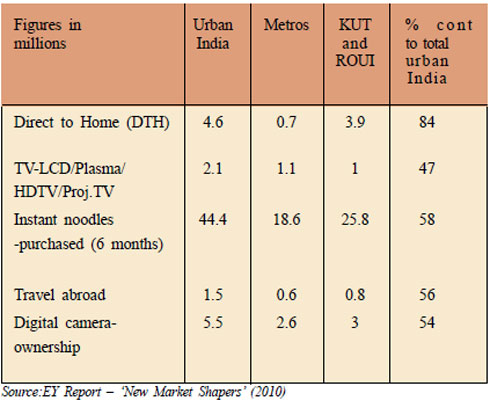

What is alarming is that print media is slated to grow at the slowest rate 9% CAGR for 2009-13 while television will grow in the same period at 14.5% as shown in fig 4.2. Television already has a dominant share, with a faster growth, it will further consolidate its position. In fact, almost all other media are expected to grow faster than Print during 2009-13 but, of course, on a much smaller base. It will be no exaggeration to suggest that with growing internet penetration, as shown in fig 4.3, the new media will have a greater impact on the people in the near future. In charting out a future path for print media, the key economic reality which is now emerging is the shift in the epicenter of lifestyle and discretionary products consumption from Metros to KUT and ROUI. There is a wealth of evidence which shows that as literacy levels of aspiration and opportunities to grow manifest itself in KUT and ROUI, the consumption patterns change dramatically from sustenance to lifestyle. The chart below shows how the consumption of non-essentials are on the rise in the key urban towns and the rise of urban India.

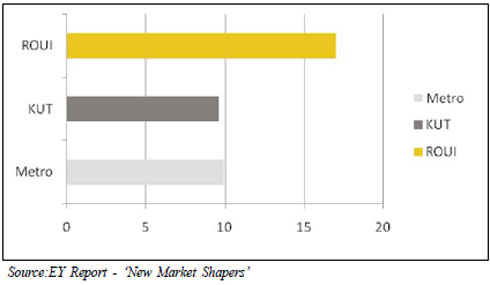

Note: 1) Metros-Top 6 cities 2) KUTs (Key Urban Towns) - 22 Tier II cities (eg.Pune,Nasik,Surat etc) 3) ROUI (Rest of Urban India) - 39 Tier III cities and 5000+towns This growth is expected to be sustained and the chart below shows that the expected volume percentage of market consumption growth is the highest in ROUI. Expected Annual Percentage of Market Consumption Growth( 2004-2015)

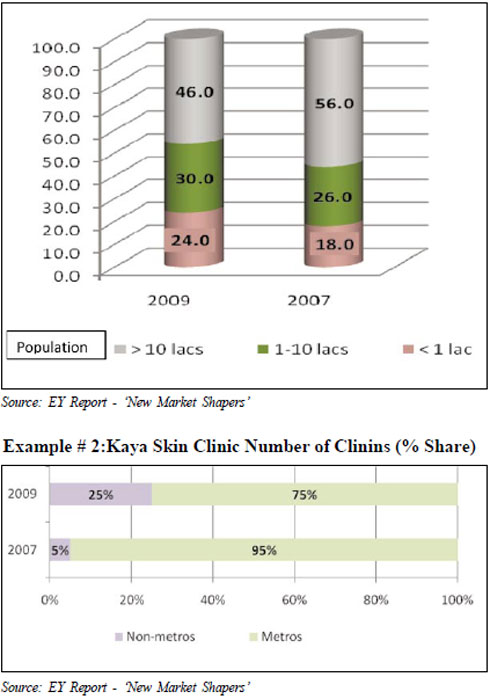

Marketeers are beginning to wake up to this reality and are now putting disproportionate emphasis on KUT and ROUI. The two examples below demonstrate as to how marketeers have begun to shift their spends from Metros to KUT and ROUI. One of the products taken in the example is consumer durables and the other is a pure lifestyle grooming product.

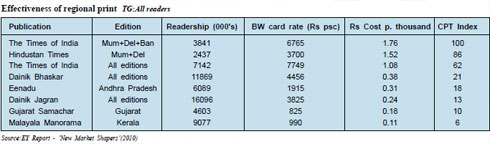

Consequently, the print advertising in these areas have also been on the rise as demonstrated in the chart below. These new markets are also far more cost-effective than the metro markets as the chart below shows :

This clearly proves that print media has a lot of head room for growth with respect toadvertising rates. A lot of print media companies have been prompt enough in taking advantage of this new phenomenon. The route then so far has been one of localization as well as splits. For example, Dainik Jagaran, from the Jagaran Prakashan group, currently has 37 editions over 11 states the number of sub-editions has crossed 250. In 1997, it had 13 editions. It added 18 editions between 1997 and 2006 and 6 editions in 2007-8. Another similar example is of Dainik Bhaskar. In 2006, it had 14 editions in 5 states. In 2010, it spans 9 states with 27 editions and over 100 sub-editions. This route has also been taken by Eenadu, the leading Telegu daily, which has 23 editions, and by Daily Thanti, a leading Tamil daily with 15 editions. These examples suggest that newspapers in various parts of India are thinking along the lines of greater localization. Newspapers are also introducing greater variety in their content. The aim here is to create content to cater to every section of consumers and readers. In 2007, Jagaran Prakashan came up with i-next, a unique bilingual paper (Hindi and English) for the youth. The Hindi daily, Hindustan has launched in May 2010 Jano English, a supplement that intends to teach English to the younger population of Uttar Pradesh, Uttarakhand, Bihar and Jharkhand. As is evident newspapers are not only creating new products for the metros but are creating specific products with ROUI in mind. The internet has opened up a new challenge and therefore a new opportunity for the print media. Most newspapers are introducing websites which have interactivity through blogging, citizen journalism and infotainment. This not only helps maintain the relevance of newspapers but actually enriches the print media content .While internet remains a largely metro phenomenon, the scope of internet penetration in ROUI is large.. In conclusion, this era of changing consumption brings the real potential for growth for newspapers lying in the KUT and ROUI. These cities as has been stressed earlier are still on a sharply growing upward trajectory. With the growth of literacy, awareness, aspirations and growing financial strength, Indian consumption is seeing an unprecedented rise in these places. Therefore, while the rest of the developed world struggles with diminished print media consumption India is poised with at least 15-20 years of healthy growth. The key to all this is going to be strategies to conquer the KUT and ROUI both editorially as well as commercially to a much greater extent. nnn

|